Old bridge in the city of Koblenz, going over the Mosel river by Cristina Sarasua. Courtesy of WikiCommons

There are three significant trends with which manufacturers

need to come to terms. The first is the skills gap. According to a

2014 report jointly authored by The Manufacturing Institute and consulting firm

Deloitte:

“Over the next decade,

nearly three and a half million manufacturing jobs likely need to be filled and

the skills gap is expected to result in 2 million of those jobs going unfilled.”

The breakdown of the job requirements is over three quarters

due to “baby boomer” retirements rather than business growth; manufacturers

will see a significant amount of experience exiting the labor force over the

next 10 years. They are also finding the available labor pool lacks the

necessary skills in science, technology, engineering, and math (STEM), in

problem-solving capabilities, and in basic technical training.

The second trend

is technology adoption. Manufacturers are approaching the end of the first

generation digital automation, which according to Jim Schindler of Litzler

Automation, was essentially characterized as “relay replacement”. Modern

automation has far more capabilities than the devices which are now going out

of service. There is an interesting dynamic in digital automation; the control

devices themselves (PLCs and CNCs, for example) are not subject to Moore’s Law –

they are expected to provide reliable service for 20 years or more. It is not

unusual for a PLC to be active for over 30 years. But digital automation exists

in an environment very much subject to Moore’s Law. As the first generation of

automation gives way to the next, manufacturers are discovering that simply

swapping the new devices for the old is inadequate; there is an expectation of

tapping the business value of the capabilities of the new technology.

There is an effect of Moore’s Law on automation technology

though; it places a pricing pressure on the control devices. To a very large

extent, devices like the PLC have become a commodity – the true value comes

from vendor support rather than technical capabilities. Costs for automation

technology across the board – from controllers, to user interfaces, to advanced

robotics – have fallen over the last decade. Interestingly though, this doesn’t

seem to have caused an acceleration in the adoption of automation technology.

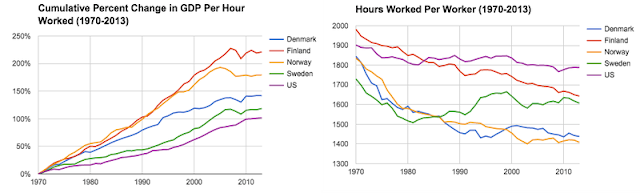

There is a fascinating article entitled “The Automation

Myth: Robots aren’t taking your job – and that’s the problem” by Matthew

Yglesias. He argues that the evidence of increasing automation adoption would

be an increasing GDP per hour worked and a decreasing hours worked per worker.

He points to a report showing both metrics are essentially flat over the last

five to seven years and concludes that manufacturers are not adopting technology

as they should.

In a related article in the Harvard Business Review, there is

a significant difference between the productivity of “frontier” organizations

(those that are integrating new technologies) and everyone else, which is an

obvious competitive advantage for those organizations.

"Productivity Is Soaring

at Top Firms and Sluggish Everywhere Else", HBR, August 24, 2015

The third trend

impacting manufacturing is “Smart Manufacturing”. This has been referred to as “the

next industrial revolution” and “the fourth wave”. This is all about utilizing

the leading edge technologies of Social, Mobile, Analytics, Cloud, and the

Internet of Things (SMACIT). According MIT’s Center for Information System

Research (CISR), it’s not any single technology that is causing business

disruption but an amalgam of all these technologies working together to provide

business benefit.

There are several national initiatives across the globe to

utilize the disruptive force of these technologies. Here in the US, there is

the Smart Manufacturing

Leadership Coalition. In Germany, it’s known as Industrie 4.0. In China,

it’s called “Made

in China 2025”. What is clear is that nations are expecting technology to

significantly affect the productivity of their manufacturers and are working to

ensure they remain competitive.

How should manufacturers respond to these trends? Obviously

workforce development is necessary, but by itself is insufficient to allow

manufacturers to remain competitive. Skills can be taught, but will not replace

experience. Also, some skills have low market demand – not that they aren’t

important, but without demand there will be little incentive for people to

develop those skills. Finally, skill development takes time – often months to

years – so there is no “quick fix” using labor force development to address the

skills gap. Continuous improvement initiatives such as Lean provide some

benefit, but tend to be asymptotic without innovation (“perfection” of the

current state is an upper limit). Manufacturers should institute a two-pronged

strategy for dealing with all three trends: workforce development and

technology (automation) adoption. This should be done proactively, because a

reactive approach will leave manufacturers at a disadvantage relative to

competition.

Automation isn’t just for machines either. Mechanical

automation does eliminate a great deal of human labor, and the capabilities of

modern technology (robotics and additive manufacturing, for example) allow a

much broader spectrum of tasks to be automated. But there is another category

of labor inefficiency which also benefits from automation: work processes.

Think about all the lost time in paper-handling and manual data exchange (a

human transferring information from one form of information technology into

another). Think of processes such as project time tracking, new customer

account setup, product data management, purchase requisitions, capital

authorization requests, and other processes that keep an organization running.

These processes are frequently manual, using paper forms, and require either

routing through an internal mail system or (to expedite matters) having someone

walk the form through the process steps. This kind of inefficiency impacts

workers who are among an organization’s highest paid: engineers, managers,

accountants, supervisors, directors, and senior executives. Fortunately,

automation solutions for work processes are far less capital intensive than

mechanical automation, and are well within reach of most manufacturing

organizations.

The skills gap, technology adoption, and Smart Manufacturing;

these trends will affect all manufacturers within the next decade. The marketplace

will be the ultimate judge; organizations which respond strategically to these

trends are likely to succeed. Those that don’t will struggle in the new competitive

environment that is developing.

This blog post is an

excerpt from “Bridging the Skills Gap with Automation”, presented to the

Cleveland Engineering Society at their October 21st, 2015 Industrial

and Manufacturing Conference at Case Western Reserve University in Cleveland, Ohio.

This was co-presented by Patrick Weber of Integrated Automation Consulting, Jim

Schindler of Litzler Automation,

and Mark Orzen of Clear Process

Solutions.

Are your operations

ready for the next wave of technical innovation? Find out! Register on

Integrated Automation Consulting’s website and receive your free copy of “Seven Warning Signs that Your Manufacturing

Operations are Becoming Obsolete”.